Tax time carried so much anxiety and frustration for me. Just when I thought I’d kept track of everything, there was some missing bit of information. We always found ourselves sifting through papers at one point or another.

That being said, I improve every year, and it has become less stressful with each new system I institute. It’s an uphill battle, but it’s good to be on the wining front!

I’m sharing organizing solutions to keep tax time as drama free as possible. Hopefully these tips will help you avoid anxiety and give you a head start!

Arrange Your Desk For Year-Round Paper Filing

Make it as easy as possible to file any physical papers you receive. Whether it’s paper bills, vehicle ownership & maintenance papers, receipts, health care paperwork, etc. etc.

Keep a file holder handy that only contains materials for the current year. Each year you can transfer the previous year’s files into a cardboard file box or file cabinet. Just be sure you mark the year. Don’t make filing difficult, label your files so they are easy to read, and don’t feel you have to take bills out of envelopes or go through a complicated method before filing them. We simply mark “paid” and the date on each bill.

Keep your desk organized with everything you need to pay bills and file them. For me that includes plastic dividers in my drawers with a stapler and staples, pens, my checkbook, and stamps. A mail organizer on my desktop to put bills that need to be paid. A file holder where I can file bills immediately after paying them, and a space for receipts/checks I have not yet handled.

Create A Receipt Filing System

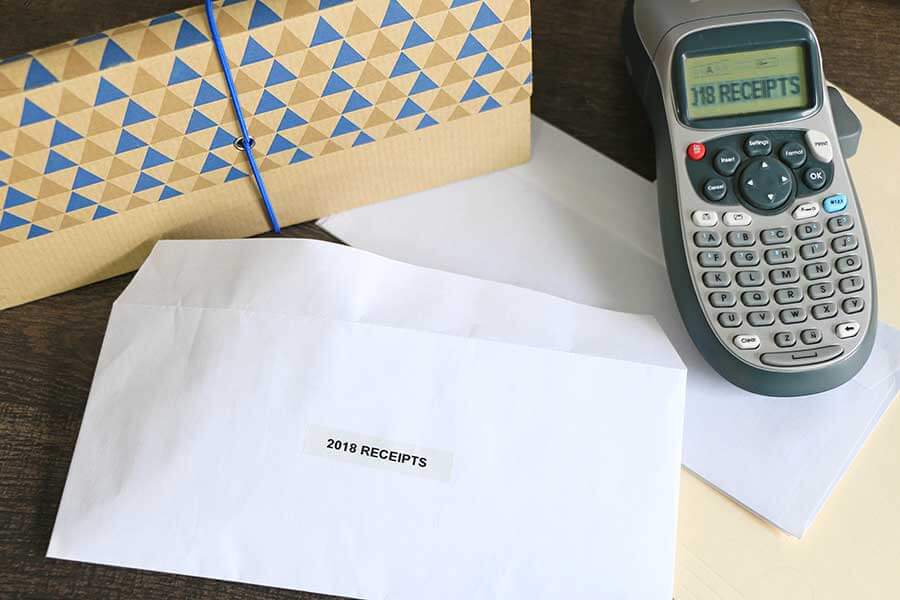

Keep a separate filing system for your shopping receipts. Buy a small but long accordion organizer and label it by the month. Include a section specially designed for receipts associated with warranties. You can also keep checks that have been e-deposited here until the recommended time to shred them.

This is a great way to keep track of your physical shopping receipts. Which, by the way, you should keep for at least a year for a variety of reasons…even if you keep digitized versions. I snap photos of my work receipts via Quickbooks, mark on the physical receipt the category I have tagged it to, and file it in the accordion organizer.

At the end of the year I place all the receipts (retaining the order) in a labeled envelope that will be placed with last year’s file box contents, and placed in storage.

Incorporate a Digital System To Keep Records

For those who prefer analog methods of bookkeeping, if it works for you…great! However the vast majority of people will greatly benefit from a digital bookkeeping method, even if that is an excel spreadsheet instead of some app or software. It will help you track your income, expenses, and properly budget.

I use Quickbooks for my business, which allows me to digitally track profit and loss, capture and tag photos of receipts, upload paperless receipts, etc. But for the household I use a simple Excel spreadsheet rather than an app or software. That makes keeping track of records and digital receipts a little more hands-on.

A tax professional advised me to download every paperless receipt and use a receipt organizing app to keep track. We often overlook those paperless receipts because we think they are on file somewhere…in our email, a list we can access on the website, etc. But what happens when we close an account with one company, or if they only retain records dating back to a certain period of time? If you are audited, they will expect to see those paperless receipts. It’s just good practice to download them and keep them organized on our computer digitally.

Mirror Your Systems After Tax Categories

Whatever method you use for bookkeeping, mirror your categories and tags after tax categories. If you use a tax professional, ask them for a list and recommendations on how you can simplify things for them next year.

We use Turbo Tax and do our taxes on our own. I quickly realized that if I didn’t categorize my expenses and income properly in Quickbooks, I would still have to do a lot of sorting and sifting through my digital files. If I had, it would be easily integrated with Turbo Tax and done in a jiffy. Now I title each category in the same way Turbo Tax does.

Be Consistent, But Make A Plan For Inconsistency

I would like to say I keep up with my filing as each bill is paid, and as each receipt or check comes in…but that isn’t always the case. Life happens.

Be as consist as possible, but plan for inconsistency. And if you aren’t a naturally organized person (I know I’m not!), it’s okay to make room for growth and improvement.

If that means creating a system to temporarily “catch” all the papers you won’t get around to filing for a little while, that’s okay. But give yourself a limit. I create an end-of-month report for my business and household, so I have until then to get it together. Sometimes I’ll block out the last day of the month or the first day of the next month just to catch up on any remaining bookkeeping. That is also when I take a moment to clean my desk and re-organize if necessary.

What systems have you found to help you with your bookkeeping, tax prep, and home office organization? We’d love to hear! Join the HMC Makers private Facebook group and share your successes and progress.

[go_portfolio id=”life_management”]

Hi Ursula,

Can you share where you purchased the super cute hanging file folders from?

Thank you!

They are from Target!

Perfect, thank you!

Best real world description of a do-able system. Thank you!!